Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file file nj w3 online?

The employer is required to file the NJ W-3 online.

How to fill out file nj w3 online?

To fill out the NJ W-3 form online, you can follow these steps:

1. Visit the New Jersey Division of Revenue and Enterprise Services website.

2. Click on the "Businesses" tab and then select "Online Services."

3. Under "Employer Services," click on "File Employer Return."

4. On the next page, select "File NJ-W-3 - Reconciliation Return for NJ Gross Income Tax Withheld."

5. In the login section, enter your business taxpayer identification number and PIN. If you don't have a PIN, click on "Get a PIN" and follow the instructions to obtain one.

6. Once logged in, you will see a list of available forms. Click on the "NJ-W-3 - Reconciliation Return for NJ Gross Income Tax Withheld" form.

7. Fill out the required information for your business, such as the employer identification number (EIN), name, address, and contact information.

8. Fill in the employee's information, including their Social Security number, name, address, wages, and withholdings.

9. Review all the information entered for accuracy and completeness.

10. Submit the form electronically, and you will receive a confirmation once it has been successfully filed.

Make sure to keep a copy of the filed NJ W-3 form for your records. Additionally, it is advisable to consult the New Jersey Division of Revenue and Enterprise Services' website or contact their support if you encounter any difficulties during the filing process.

What is the purpose of file nj w3 online?

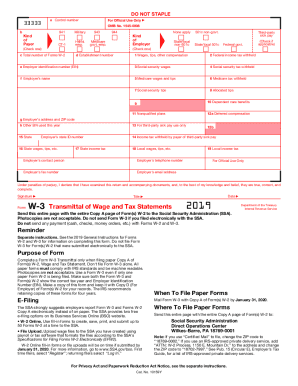

The purpose of the file "nj w3 online" is to electronically file the W-3 form in the state of New Jersey. W-3 is a transmittal summary form that reports total earnings, Social Security wages, Medicare wages, and withholding for all employees to the Social Security Administration (SSA). Filing this form online allows employers to submit the required information efficiently and accurately.

What information must be reported on file nj w3 online?

When filing Form NJ-W-3 online in New Jersey, the following information must be reported:

1. Employer Information:

- Employer Name

- Employer Identification Number (EIN)

- Address

- Contact Information

2. Wage and Tax Information:

- Total wages, tips, and other compensation paid to employees during the reporting period

- Total New Jersey income tax withheld from employees' wages

- Total New Jersey unemployment insurance (UI) contributions paid by the employer

- Total employer disability insurance (DI) contributions paid

- Total employer workforce development (WF) contributions paid

3. Employee Information:

- Name

- Social Security Number

- Wages, tips, and other compensation paid to each employee during the reporting period

- New Jersey income tax withheld from each employee's wages

It is important to note that this information may vary depending on the specific requirements and updates provided by the New Jersey Division of Taxation. Therefore, it is always recommended to refer to the official guidelines and instructions provided by the tax authority when filing Form NJ-W-3 online.

When is the deadline to file file nj w3 online in 2023?

The specific deadline for filing Form NJ-W3 online in 2023 is not available as it depends on the state of New Jersey tax authority. It is recommended to check the official website of the New Jersey Division of Taxation or consult with a tax professional for the most accurate and up-to-date information regarding filing deadlines for the NJ-W3 form in 2023.

What is the penalty for the late filing of file nj w3 online?

According to the New Jersey Division of Revenue and Enterprise Services, if you fail to file your W-3 form on time, you may be subject to a penalty. The penalty amount can vary depending on the number of employees you have. For businesses with 10 or fewer employees, the penalty is $25 for each month the W-3 form is not filed, up to a maximum of $250. For businesses with more than 10 employees, the penalty is $50 for each month, up to a maximum of $500. It is important to note that these penalties can increase if the filing delinquency continues.

How do I execute nj w 3 instructions online?

pdfFiller makes it easy to finish and sign nj w 3 unc form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the nj w3 2019 form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your annual reconciliation of tax withheld nj and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit new jersey w3 form on an Android device?

You can make any changes to PDF files, like nj w 3 annual reconciliation of tax withheld form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.